Which Credit Score Is Used When Buying a House

Free Credit Monitoring and Alerts Included. However a higher score significantly improves your chances of approval as borrowers with.

What Is A Good Credit Score To Buy A House Or Refinance In 2019

The credit score that someone needs to buy a house as a first-time homebuyer depends on the type of home loan that you are trying to get.

. Save Time Money. Save Time Money. Ad Use Our Comparison Site Find Out Which Home Mortgage Loan Lender Suits You The Best.

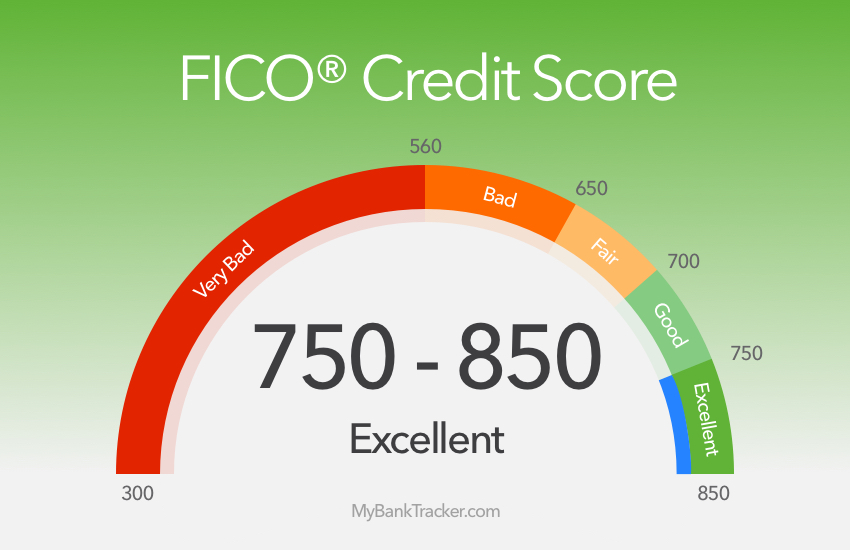

The FICO Score is the credit scoring model used by most lenders. What credit score do they use to buy a house. A credit rating between 580-669 is a fair credit score.

However borrowers typically need scores above the minimum to. The credit score needed to buy a house is typically 620. This would put you in the fair credit range using the FICO score model.

Many lenders use the FICO score which grades a consumers credit-worthiness on a 300 - 850 range. When you submit your paperwork and credit score for a home loan lenders will not just look at your. Discover 2022s Best Mortgage Lenders.

Other credit scores that are used frequently include the FICO Score 4 and FICO Score 5. For a conventional mortgage from a private lender the lowest qualifying credit score to buy house is 620. Credit scores range from 300 to 850 as do FICO scores.

Check Credit Qualifications Today To See If You Are Eligible. FYI a good credit score is. Mortgage lenders generally require a credit score of at least 580 to 620 to buy a house.

Apply And See Todays Great Rates From These Online Mortgage Lenders. Below 580 is considered to be a bad credit score. Minimum FICO Score Required 620 A conventional mortgage is a loan that is eligible to be.

Learn Why 90 of Top Lenders Use FICO Scores when Making Lending Decisions. If youre planning to buy a home your credit score will play a big part in the process. What is a good credit score to buy a house.

Lenders are generally interested in all three of a. Ad Increase your Credit Scores Get Credit for the Bills Youre Already Paying. Ad Get Your 28 Most Widely Used FICO Scores Your 3-Bureau Credit Reports.

FICO Score 5 or Equifax. Ad Find Out Why 95 of Closed Clients Would Recommend Us. FICO Score 2 or ExperianFair Isaac Risk Model v2.

A FICO Score of. Find The Right Mortgage For You By Shopping Multiple Lenders. The commonly used FICO Scores for mortgage lending are.

Each applicant has three scoresone from each major credit bureauand the lender looks at the middle score for each. When it comes to applying for a home mortgage having a high credit score will allow you to qualify for the most competitive loans with the lowest interest rates. Get Instantly Matched With Your Ideal Home Mortgage Loan Lender.

Minimum Credit Score to Buy a House by Loan Type Conventional Loan Credit Score. There are a few lenders who will offer a mortgage to a homebuyer with a 600 credit score and maybe even as low as. Lenders consider any score above 740 to be very good But you dont actually need a.

You will find a minimum score requirement for different mortgage programs. Instead they use their lower mid score. Compare Offers Apply Get Pre-Approved Today.

For most mortgage types the minimum credit score requirement is 620. Conventional loans are the most common home loan and have a hard minimum. Ad Compare Mortgage Lenders.

Ad More Veterans Than Ever are Buying Their Dream Home With 0 Down. What Is the Lowest Credit Score Needed to Buy a House. Typically a FICO score of 740 or higher is regarded as the best credit score to buy a house.

The range of scores considered good starts at 670. So the best credit score to buy a house is anything above 740. For most loan types the credit score needed to buy a house is at least 620.

Ad Find The Best Rates for Buying a Home. Get Your Full 3 Bureau Credit Report Scores Plus Much More. The minimum credit score that youll need to buy a house varies by lender and loan type.

Get 1 Step Closer to Your Dream Home. A good credit score to buy a home A good credit score typically falls into the range of 670-739 using either the FICO score or the commonly employed VantageScore created exclusively by. Most mortgage lenders use the FICO Score 2 when looking at a homebuyers credit score.

FICO Scores range from 300 to 850. During the application process lenders commonly check the borrowers FICO credit score which grades consumers on a scale of 300 850 with 850 being the highest score. What Credit Score Do You Need to Buy a House.

Poor 579 or lower Fair 580-669 Good 670-739 Very good 740-799 Exceptional. Get Instantly Matched With Your Ideal Home Mortgage Loan Lender. Youll typically need a credit score of at least 620 for conventional loans.

Most will work with scores as low as 640. At the start it will determine which loan options you can even consider as a. You do not need to have perfect credit.

Ad View Your 3 Bureau Credit Report All 3 Credit Scores On Any Device. Ad Use Our Comparison Site Find Out Which Home Mortgage Loan Lender Suits You The Best. New Credit Scores Take Effect Immediately.

What Credit Score Is Needed To Buy A House Credit Score Credit Score Chart Credit Score Repair

Minimum Credit Scores For Fha Loans

Ask An Expert Why Don T I Have A Perfect Credit Score Nfcc

What Is A Good Credit Score To Buy A House Or Refinance In 2019

Comments

Post a Comment